- Background

The Ministry of Commerce announced that the Secretariat for Foreign Trade of Brazil issued Notice No. 39 of 2025 in the Official Gazette on June 3, deciding to initiate an anti-dumping investigation into hot-rolled coil (HRC) (Portuguese: Laminados a quente) imported from China, in response to applications from three companies: ArcelorMittal Brasil S.A., Gerdau Açominas S.A., and Usinas Siderúrgicas de Minas Gerais S.A. The NCM codes of the products under investigation are 72081000, 72082500, 72082610, 72082690, 72082710, 72082790, 72083610, 72083690, 72083700, 72083810, 72083890, 72083910, 72083990, 72084000, 72085300, 72085400, 72089000, 72111300, 72111400, 72111900, 72119010, 72119090, 72253000, 72254090, and 72269100. The dumping investigation period for this case is from July 2023 to June 2024, and the injury analysis period is from July 2019 to June 2024.

- In 2025, HRC exports to Brazil surged YoY, but the monthly average remained below 60,000 mt

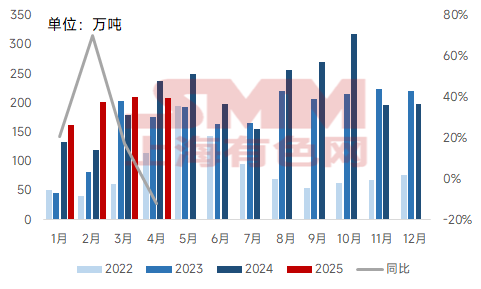

Figure 1 - Total exports of the products under investigation from China and YoY changes from 2022 to April 2025

According to data from the General Administration of Customs, since 2022, the export volume of the products under investigation in China has shown a trend of increasing year by year, with a significant increase in 2023. By 2024, the annual export volume of the products under investigation reached 25.1053 million mt. As of April this year, the export volume has reached 7.8073 million mt, representing a YoY increase of 16.77% (the export volume in the same period of 2024 was 6.6862 million mt), with a monthly average of 1.9518 million mt.

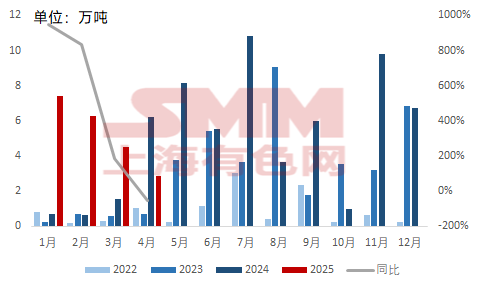

Figure 2 - Total exports of the products under investigation from China to Brazil and YoY changes from 2022 to April 2025

The total volume of HRC exported from China to Brazil has also grown rapidly in recent years, increasing from 100,000 mt/year in 2022 to 600,000 mt/year in 2024, a sixfold increase. Based on data from the first four months of this year, China exported a total of 211,000 mt of HRC to Brazil, representing a YoY increase of approximately 130.02% (the export volume in the same period of 2023 was 91,700 mt). However, in absolute terms, the monthly average for the first four months still did not exceed 60,000 mt, which is significantly different from the monthly average export volume of domestic HRC!

- China's HRC exports to Brazil account for less than 3%, with negligible impact from anti-dumping measures

Table 1 - Ratio of the total volume of the products under investigation exported to Brazil to China's total exports from 2022 to April 2025

In terms of the total volume of the products under investigation exported to Brazil as a proportion of China's total exports, the overall ratio fluctuated between 1% and 3%. In 2022, this ratio was only about 1%, indicating minimal effective impact. In 2025, the total volume of the products under investigation exported to Brazil decreased month by month, while the total export volume of the products under investigation increased month by month, indicating that China is increasing the proportion of the products under investigation exported to other countries.

Overall, according to data from the General Administration of Customs, in the first four months of 2025, China's total exports of HRC to Brazil amounted to only 211,000 mt, accounting for 2.70% of China's total HRC exports, indicating a limited overall impact. Data from 2025 shows that the top five countries for China's HRC exports were Vietnam, Pakistan, Saudi Arabia, South Korea, and the UAE. Among them, Vietnam and South Korea have successively initiated anti-dumping investigations against China's HRC. Vietnam has already imposed provisional anti-dumping measures, and there have even been recent rumors that wide coils, which were previously excluded from the anti-dumping scope, may be added to the anti-dumping list again. On March 4 this year, South Korea officially announced the initiation of an anti-dumping investigation against China's hot-rolled steel coils. Currently, China's HRC, the largest category in terms of steel export share, is facing an increasing number of anti-dumping investigations. Perhaps for export traders, exploring ways to increase exports of varieties that are not yet subject to anti-dumping measures could be a good strategy.

SMM will track the progress and impact of overseas anti-dumping investigations on steel in real time. Please stay tuned for relevant reports. For more information, follow SMM's official account~

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)